Junte-se ao PU Xtrader Challenge Hoje

Queremos traders sérios e consistentes. Atenda aos nossos requisitos de negociação e obtenha uma conta de negociação real financiada por nós.

Junte-se ao PU Xtrader Challenge Hoje

Queremos traders sérios e consistentes. Atenda aos nossos requisitos de negociação e obtenha uma conta de negociação real financiada por nós.

12 June 2023,05:57

Daily Market Analysis

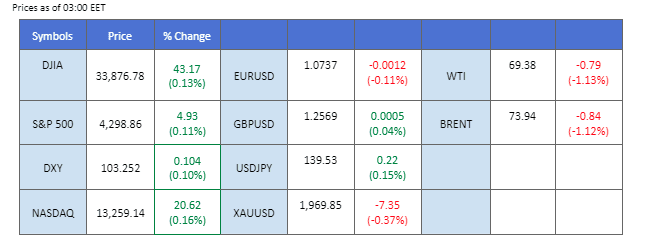

The upcoming week is expected to be quite busy for investors, as significant events are anticipated to have a profound impact on the market. The U.S. Consumer Price Index (CPI) will be released on Tuesday, setting the stage for the Federal Reserve’s interest rate decision. The market remains uncertain about the monetary policy the Fed will adopt in this regard. In contrast, the European Central Bank (ECB) is scheduled to announce its interest rate decision, with a high level of certainty that it will raise rates by 25 basis points during this round. On top of that, the dovish tone from the BoJ governor Kazuo Ueda has left the markets speculating whether interest rates in Japan will stand pat. Elsewhere, oil prices continue to decline due to a deteriorating demand outlook, leading major investment banks such as Goldman Sachs to revise their oil price forecasts for the year.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (73.6%) VS 25 bps (26.4%)

The US Dollar edged lower ahead of the FOMC meeting as market expectations lean toward the central bank pausing its rate hike cycle that has been in motion for the past 15 months. All eyes will be on the Fed’s “dot plot,” which outlines policymakers’ expectations for future tightening. However, the outcome remains uncertain, as some Fed officials have expressed reservations about prematurely ending the rate hikes. Market participants will closely monitor the outcome of these developments for insights into the central bank’s future policy path.

The dollar index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the index might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 104.35, 105.20

Support level: 103.50, 102.75

As global investors eagerly anticipate key events this week, gold prices maintained a flat trend. Market participants are bracing themselves for significant market-moving developments, with the focus squarely on the Federal Reserve’s upcoming policy decision and the US inflation reading on Tuesday. The outcome of these events will play a crucial role in shaping market sentiment and determining the trajectory of gold prices.

Gold prices are trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the commodity might continue to consolidate in a range since the RSI stays near the midline.

Resistance level: 1980.00, 2005.00

Support level: 1940.00, 1915.00

The Euro staged a modest recovery, fueled by anticipations of a more hawkish stance from the European Central Bank (ECB). With its meeting scheduled a day after the Federal Reserve’s decision, the ECB is expected to deviate from its U.S. counterpart and proceed with a quarter-point interest rate hike. Market participants are already anticipating another rate increase of a similar magnitude in July. ECB President Christine Lagarde has indicated that it is premature to declare a peak in core inflation, emphasising the need for further rate hikes. Although Eurozone inflation stands at 6.1%, it is still well above the ECB’s 2% target.

EUR/USD is trading higher while currently near the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 50, suggesting the pair might trade lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 1.0765, 1.0840

Support level: 1.0665, 1.0585

The Japanese Yen continued to display weakness as the divergence in monetary policies between the Bank of Japan (BOJ) and other global central banks put pressure on its demand. With the upcoming BOJ meeting on Friday, market expectations lean towards no changes in monetary policy. The recently appointed Governor Kazuo Ueda has signalled that ultra-easy policy will persist until there are stable and sustainable wage gains and inflation.

USD/JPY is trading flat while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the pair might extend its losses after breakout since the RSI retraced sharply from the overbought territory.

Resistance level: 142.05, 146.20

Support level: 138.50, 133.85

The Sterling traded strongly against the USD and is trading on an uptrend support level. Investors are uncertain that the Fed interest rate decision may refer to the U.S. CPI reading to gauge the Fed monetary policy. Besides, the market expects the BoE to continue to raise its interest rate, but investors must wait until next week for the decision to be announced. However, the British GDP will be released on Wednesday and a better-than-expected number from the reading will give the BoE more room to fight against stubborn inflation.

The cable is currently traded strongly against the USD above the uptrend support line is testing its near resistance level at 1.2570, the RSI is about to break into the overbought zone while the MACD continues to climb which depicts a bullish signal for the cable.

Resistance level: 1.2570, 1.2650

Support level: 1.2495, 1.2414

The Dow Jones Industrial Average experienced a relatively sideways price movement while investors are awaiting the crucial economic data that may impact the Fed’s interest rate decision. The U.S. CPI is expected to be softer than the previous reading and if it is, the Fed may lean to a more dovish monetary policy. As a result, a dovish monetary policy from the Fed may continue to fuel the index to edge higher. The Dow is left behind as compared to its peers like the Nasdaq and S&P as the latter have gained more in the past month.

The Dow is trading strongly after getting out from the downtrend channel. The RSI is moving near to the overbought zone while the MACD is moving upward strongly; both depict a bullish signal for the Dow.

Resistance level: 34250, 34890

Support level: 33700, 33260

The downward trajectory in oil prices persisted as multiple central banks held their meetings this week, spurring additional uncertainties for the demand outlook. Any decisions to tighten monetary policy are expected to exert continued pressure on economic growth, dampening the attractiveness of the oil market. Investors are closely monitoring these central bank actions for indications of their impact on global oil demand and market dynamics.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 70.70, 74.20

Support level: 67.95, 65.55

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

8 August 2023, 06:21 U.S. Equity Market Closes Higher Ahead of CPI

7 August 2023, 06:10 Dollar Softer After NFP Comes Short

4 August 2023, 06:20 BoE Delivers 25 BPS Rate Hikes Softening Pound Sterling

Novos Registos Indisponíveis

Atualmente, não estamos a aceitar novos registos.

Embora novos registos não estejam disponíveis, os utilizadores existentes podem continuar com os seus desafios e atividades de trading como habitualmente.