Junte-se ao PU Xtrader Challenge Hoje

Queremos traders sérios e consistentes. Atenda aos nossos requisitos de negociação e obtenha uma conta de negociação real financiada por nós.

Junte-se ao PU Xtrader Challenge Hoje

Queremos traders sérios e consistentes. Atenda aos nossos requisitos de negociação e obtenha uma conta de negociação real financiada por nós.

14 July 2023,06:34

Daily Market Analysis

The release of lower-than-expected CPI data on Wednesday has significantly impacted the financial market. The equity market has extended its gains, while gold prices have risen by over 1.5% following the data release. Conversely, the U.S. dollar continues to decline, breaking below the key psychological support level of $100. On a different note, former policymakers in Japan speculate that the Bank of Japan (BoJ) will soon make adjustments to its monetary policy, considering the country’s inflation rate has remained above 3% throughout 2023. If the BoJ scraps the yield curve control and raises its negative interest rate, it could lead to a stronger Japanese Yen against major currencies. Furthermore, oil prices have steadily risen due to multiple factors, including the weakened dollar and disruptions in oil production in Libya and Nigeria. As of now, oil prices have gained over 5%.

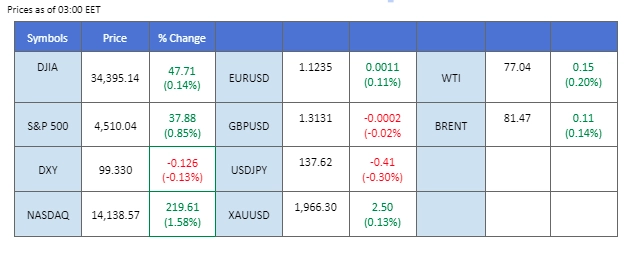

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (8%) VS 25 bps (92%)

The US Dollar slumped, weighed by cooling US inflation and weaker-than-expected consumer price index (CPI) data, investors are anticipating that the Fed will adopt a more dovish approach. Such expectations had eroded the greenback’s yield advantage over other currencies, leading to its lowest level since April 2022. The US Producer Prices Index (PPI) data further reinforced the view that inflation is moderating. In June, the PPI notched up a mere 0.10% increase year-on-year, marking the smallest rise in nearly three years. This follows Wednesday’s CPI report, which revealed that US core inflation slowed at a much faster rate than anticipated.

The dollar index is lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 101.45, 104.25

Support level: 98,70, 94.75

Following the release of downbeat inflation data, the US Treasury market witnessed a significant tumble, leading to a surge in gold prices. The depreciation of the US dollar, resulting from the weakening inflation outlook, further fueled demand for gold as it became relatively cheaper in dollar terms.

Gold prices are trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 1970.00, 1985.00

Support level: 1950.00, 1930.00

The euro has gained about 2.4% this week where the softer U.S. CPI data alone boosted the euro by 2%. The latest piece of U.S. inflation data led the market to predict that the Fed will not need to hike the interest rate as high as previously thought. Economists predict that the dollar will continue to weaken through 2024. Investors highly anticipate the Eurozone CPI, higher-than-expected reading will boost the euro to trade higher against the weakening dollar.

EUR/USD traded strongly and has been breaking new yearly highs. The RSI has been strong and stayed in the overbought zone since Wednesday. The MACD continues to rise indicating the bullish momentum is strong.

Resistance level: 1.1338, 1.1410

Support level: 1.1157, 1.1088

The Cable has risen by more than 2% this week, and the Softer US. Inflation data provide strong support for Sterling. The Sterling has broken above its key psychological level at 1.3000 which provides a bullish signal for the Cable. While investors are awaiting for the UK’s CPI data that is going to be released next week and is expecting to provide a bullish catalyst for the Cable to trade higher since the UK’s inflation rate is relatively high amongst its peers.

The Cable is trading on a bullish momentum and is now trading above its psychological level at 1.3000. The RSI has broken into the overbought zone while the MACD crossed above the zero line suggesting a bullish signal for the Cable.

Resistance level: 1.3199, 1.3275

Support level: 1.3000, 1.2910

Lacklustre inflation data rocked the US Treasury market, sparking a surge in the US equity market. The latest US Producer Prices Index (PPI) revealed the smallest year-on-year increase in nearly three years, reinforcing the belief that inflation is moderating. Combined with the recent disappointing Consumer Price Index (CPI) report, it is fueling speculation that the Federal Reserve may take a more cautious approach to monetary policy tightening.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the pair might extend its gains after successfully breakout above the resistance level.

Resistance level: 34445.00, 34895.00

Support level: 33700.00, 33260.00

The USD/JPY pair extended its downward trajectory, plunging for a sixth consecutive trading session and reaching a nearly two-month nadir, propelled by the ongoing convergence of yields between the United States and Japan. The tightening yield differential has taken centre stage as inflation in the US shows signs of subsiding, exacerbated by disappointing data on the June Producer Price Index (PPI) that fell short of market forecasts. This unanticipated setback in the PPI, coupled with recent subdued Consumer Price Index (CPI) reports, has further dampened inflation expectations for the United States, exerting additional pressure on the greenback against the yen.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 140.75, 144.50

Support level: 137.35, 134.05

Oil prices soared to their highest level in almost three months as expectations of tightened monetary policy eased. The International Energy Agency (IEA) released a report predicting a record-high oil demand for the year, although the increase was slightly adjusted downward due to broader economic headwinds and expected interest rate hikes. Nonetheless, the overall tone of the report, combined with an optimistic outlook in the OPEC report, maintained a positive sentiment in the world oil demand outlook.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 78, suggesting the commodity might enter overbought territory.

Resistance level: 77.30, 79.75

Support level: 73.70, 70.30

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

8 August 2023, 06:21 U.S. Equity Market Closes Higher Ahead of CPI

7 August 2023, 06:10 Dollar Softer After NFP Comes Short

4 August 2023, 06:20 BoE Delivers 25 BPS Rate Hikes Softening Pound Sterling

Novos Registos Indisponíveis

Atualmente, não estamos a aceitar novos registos.

Embora novos registos não estejam disponíveis, os utilizadores existentes podem continuar com os seus desafios e atividades de trading como habitualmente.