Junte-se ao PU Xtrader Challenge Hoje

Queremos traders sérios e consistentes. Atenda aos nossos requisitos de negociação e obtenha uma conta de negociação real financiada por nós.

Junte-se ao PU Xtrader Challenge Hoje

Queremos traders sérios e consistentes. Atenda aos nossos requisitos de negociação e obtenha uma conta de negociação real financiada por nós.

23 June 2023,06:14

Daily Market Analysis

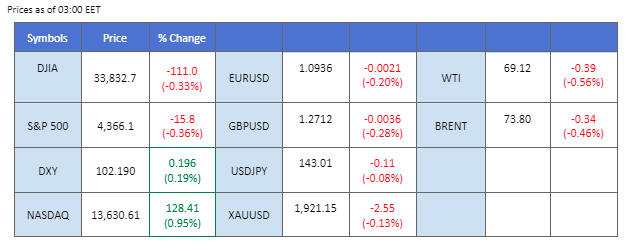

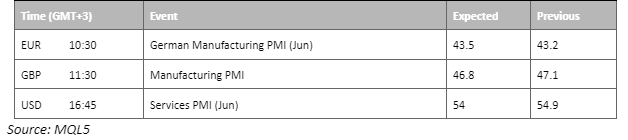

Markets have increased the probability of the Federal Reserve raising interest rates, a sentiment also applied to other major central banks worldwide, including those of the U.K, Switzerland, and Norway. Furthermore, U.S. Treasury Secretary Janet Yellen supports the Fed’s monetary policy, emphasising the need to focus on containing inflation rather than being concerned about the likelihood of a recession. In a surprising move, the Bank of England (BoE) raised interest rates by 50 basis points last night, surpassing market expectations of a 25 basis point increase. However, the bullish news failed to impact the Sterling as investors expressed concerns about the potential negative consequences of an intensified rate hike on the U.K. economy. Conversely, oil prices experienced a decline as major central banks worldwide increased interest rates, which could hamper global economic activity.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (26%) VS 25 bps (74%)

The Bank of England’s surprising rate hike has prompted investors to reassess the likelihood of more aggressive monetary tightening by the Federal Reserve in the coming months. Market participants have begun adjusting their expectations for the Fed’s next monetary policy decisions, leading to a rebound in US Treasury yields and a strengthening of the US Dollar. This reevaluation reflects the interconnectedness of global monetary policies and highlights the potential impact of the BoE’s decision on other major central banks, including the Federal Reserve.

The dollar index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the index might extend its gains since the RSI rebound sharply from oversold territory.

Resistance level: 102.75, 103.35

Support level: 102.00, 101.35

Gold prices have experienced a significant downturn as several major central banks have adopted an assertive approach in raising interest rates. This move has prompted investors to seek alternative avenues for securing higher risk-free returns, leading to a substitution of the safe-haven appeal of gold with government bonds.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 1930.00, 1955.00

Support level: 1895.00, 1865.00

After Jerome Powell gave his hawkish statement in his semi-annual monetary report days earlier, his view is supported by U.S. Treasury Secretary Janet Yellen. She claimed that the U.S. is able to avoid getting into recession given the current tight labour market and a gradually slowing in inflation rate; policymakers can now fully focus on containing the price in the U.S. Dollar was strengthened last night and hammered the euro from its monthly high at 1.1012.

The EUR/USD pair dropped by more than 0.5% for the past 2 days and nearly erased its gains on Wednesday. The MACD gives a bearish divergence signal while the RSI has declined from the overbought zone to near the 50-level.

Resistance level: 1.1030, 1.1088

Support level: 1.0892, 1.0848

Since the BoJ is the only Central bank in the world that implements an expansionary monetary policy, which keeps its interest rate extremely low, such policy moves will hamper the Japanese Yen from strengthening, including against the USD. The Fed’s semi-annual monetary policy report showed that the Fed is early taming the inflation rate down to 2% which has a high probability that the Fed may continue to raise the rate in July. Such a contradictory move between the Fed and BoJ will see the Japanese Yen continue to struggle against the USD.

USD/JPY has formed an uptrend trendline and has a bullish momentum where it is breaking one resistance level by another. The RSI showed that the buying power has outweighed the selling power, while the MACD gave a bullish signal as well.

Resistance level: 143.20, 144.78

Support level: 141.90, 140.20

Pound Sterling surged in the first-reaction following the Bank of England unleashing their hawkish monetary policy, though it retraced while re-testing the crucial support level as investors took-profit. In a move that caught markets off guard, the Bank of England (BoE) announced a substantial interest rate increase of 50 basis points, defying market expectations. With concerns over persistent British inflation, the BoE’s Monetary Policy Committee voted 7-2 in favour of raising the main interest rate to 5%, reaching its highest level since the global financial crisis in 2008.

GBP/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 43, suggesting the pair might extend its losses after breakout below the support level

Resistance level: 1.2980, 1.3270

Support level: 1.2695, 1.2300

The Dow closed the day flat as investors remained in a holding pattern, eagerly awaiting additional catalysts that would provide clearer trading signals. Notably, market participants were caught off guard by the Bank of England’s decision to implement a larger-than-anticipated 50 basis point rate hike, a move aimed at addressing the persistent inflationary pressures plaguing Britain. This unexpected development serves as further evidence that the global economy continues to grapple with the challenges posed by surging prices. Looking ahead, market sentiment indicates a 77% probability of another 25-basis point rate hike at the conclusion of the Federal Reserve’s July meeting, as per CME’s FedWatch tool, underscoring the anticipation surrounding future monetary policy decisions.

The Dow is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 44, suggesting the index might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 34460.00, 35485.00

Support level: 33815.00, 32695.00

The tightening monetary policy cycle implemented by major central banks has instilled fears about the global economy and its impact on fuel demand, resulting in a sharp decline in oil prices. The prospect of higher interest rates is causing concerns among market participants as it may hinder economic growth, subsequently reducing the demand for oil.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 69.85, 73.90

Support level: 67.25, 64.90

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

8 August 2023, 06:21 U.S. Equity Market Closes Higher Ahead of CPI

7 August 2023, 06:10 Dollar Softer After NFP Comes Short

4 August 2023, 06:20 BoE Delivers 25 BPS Rate Hikes Softening Pound Sterling

Novos Registos Indisponíveis

Atualmente, não estamos a aceitar novos registos.

Embora novos registos não estejam disponíveis, os utilizadores existentes podem continuar com os seus desafios e atividades de trading como habitualmente.